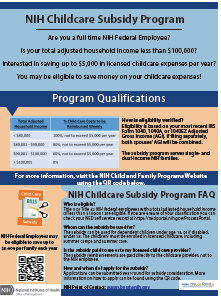

NIH Child Care Subsidy Program

"The subsidy program is a great benefit to have. As a single parent it helps to make child care more affordable. I would definitely recommend it to any parent that is not taking advantage of this opportunity."

(Comment from Subsidy Participant)

The NIH Childcare Subsidy Program Total Adjusted Household Income eligibility level is $100,000 (based on most recent IRS Form 1040, 1040A, or 1040 EZ Adjusted Gross Income line) and Percentage Levels of Subsidy Assistance cover up to 100% of the participant's childcare expenses (not to exceed $5,000 per year).

Click on the NIH Child Care Subsidy Program flyer below for more information.

ON-LINE REGISTRATION is now available!

Purpose

The purpose of the NIH Child Care Subsidy Program is to provide financial assistance to ease the burden of childcare expenses for eligible NIH full-time federal employees through the use of agency appropriated funds in accordance with Public Law 107-67, Sec. 630.

The NIH Child Care Subsidy Program is able to serve eligible NIH Title 5 and Title 42 full-time federal employees with dependent children under the age of 13 (or, if disabled, under the age of 18) living in their home who are enrolled in family home or center-based child care (or before- and after-care). Childcare providers must be licensed and/or regulated by state or local authorities.

Eligible children include a biological child, an adopted child, a stepchild, a foster child who lives with the NIH federal employee, or a child for whom a judicial or legal determination of support has been obtained, and to whose support the NIH federal employee makes regular and substantial contributions.

Click on the buttons below to learn about the NIH Child Care Subsidy Program.

Eligibility for Childcare Subsidy Program

To qualify for the childcare subsidy program you must:

- Be an eligible NIH Title 5 or Title 42 employee with dependent children

living in your home under the age of 13, or children who are disabled and under age 18.

- Have a total adjusted household income of $100,000 per year or less.

- Use childcare that is licensed and/or regulated by state and/or local authorities.

Work full time.

NIH trainees/fellows and NIH contractors are not eligible for this program by Federal law.

Childcare subsidy is limited to $5,000.00 per year, per family.*

Completed applications will be accepted in the order they are received and approved applications will be effective at the beginning of the month in which they are received.

Current Subsidy Tiered Reimbursement Percentages

| $100,001 or more | 0% |

| $90,001 - $100,000 | 60%, not to exceed $5,000 per year |

| $80,001 - $90,000 | 80%, not to exceed $5,000 per year |

| $80,000 or less | 100%, not to exceed $5,000 per year |

* This program includes a cap of $5,000 per family, per year. Subsidy benefits may be affected if an NIH full-time employee or their spouse is receiving other federal, state, or local childcare subsidies.

** Refers to total adjusted household income based on most recent IRS Form 1040, 1040A, or 1040EZ Adjusted Gross Income (AGI). If filing separately, AGI from both spouses' tax returns are combined.

Dependent Care Flexible Spending Account

In accordance with Section 129 of the Internal Revenue Code, an employee can generally exclude from gross income up to $5,000.00 of benefits received under a Dependent Care Assistance Program each year. This would include the DCFSA and the NIH Child Care Subsidy Program. Subsidy benefits from both of these programs may not exceed the $5,000.00 limit.

For further guidance, please refer to:

Dependent Care FSA

How to Apply

NIH Title 5 or Title 42 full-time employees can apply at any time by submitting a complete subsidy application package on-line, via email, fax, or postal mail.

Eligible NIH full-time federal employees interested in participating in this program should carefully review all of the information and requirements and follow these procedures:

If the employee's child(ren) is/are not yet enrolled in childcare, employees should identify a licensed and/or regulated center-based or family child care provider, to ensure there is a space for their child(ren) before applying for the subsidy. Once space is verified, employees can complete the subsidy application forms.

- If employees already have their child(ren) enrolled in licensed and/or regulated childcare (center-based or family child care), and they wish to receive a subsidy, they should fill out the subsidy application forms.

The Complete Subsidy Application Package Consists of:

Request Subsidy Application Form:

If you are unable to open the links above and would like to have paper copies of the subsidy application forms mailed/faxed to you, please contact the NIH Child and Family Programs team at (301) 827-3250.

The completed application can now be submitted four ways:

On-Line Application (www.feeachildcareservices.com)

Click on the link above, it will take you to the FEEA website. Click on the Programs button (on the lower left) and then click on Apply Now button (on the far right). Be sure to scan all the required documents and forms for easy upload.

Fax (202-559-1380)

Email (childcare@feea.org)

Postal mail address:

Federal Employee Education and Assistance Childcare Services, Inc.

NIH Child Care Subsidy Program

1641 Prince Street

Alexandria, VA 22314

The FEEA Childcare Services, Inc., will review applications, make subsidy decisions, and notify the applicant and childcare provider of approval or disapproval within 10 business days of receipt of a complete application and supporting documents.

Tuition assistance reimbursements are made directly to the childcare provider, not to the NIH employee. The employee will receive the subsidy in the form of reduced fees from the childcare provider. Please note: as this is a reimbursement program, subsidies are paid in arrears (after childcare hs been provided for the month).

Completed applications will be processed in the order they are received.

This is an NIH-sponsored program with an annual spending limit. When maximum expenditure of funds occurs, applications will be placed on a waitlist.

Participants are

required to re-apply annually.

Questions about the application process should be made to:

FEEA Childcare Services, Inc. (202) 559-7042.

www.feeachildcareservices.com Oversight and Administration

Section 630 of Public Law 107-67 allows federal agencies to provide financial assistance to lower income Federal employees for childcare in licensed and/or regulated center-based or family childcare homes.

The NIH has chosen the Federal Employee Education and Assistance (FEEA) Childcare Services, Inc., to manage the agency's

Child Care Subsidy Program. The FEEA Childcare Services Inc. will receive the completed application, make the subsidy determination based on eligibility and funding, and notify the applicants and the childcare provider of the decision.

Questions about the application process should be addressed to FEEA Childcare Services Inc. at the following telephone number:

(202) 559-7042. www.feeachildcareservices.com

Need More Information

If you have additional questions, please call the NIH Child and Family Programs team at:

301-827-3250.

Don't qualify for the child care subsidy? See how you can participate in NIH family programs like the back-up care program, legal and financial resources and referral services, and child care referral services.